In mid-December, the Ohio Department of Development awarded $36,177,724 in Ohio Historic Preservation Tax Credits for the rehabilitation of 27 historic buildings. Together, the projects are expected to leverage approximately $478 million in private investments in 10 communities.

“Giving these buildings new life preserves Ohio’s past and provides economic opportunity for the future,” said Ohio Governor Mike DeWine. “By preserving parts of our past, we are also enhancing the quality of life in our downtowns and neighborhoods.”

“What is old becomes new again through the use of historic tax credits,” said Lt. Governor Jon Husted. “These properties have the infrastructure around them to thrive, and with new investment, can anchor the revitalization of neighborhoods and communities.”

The awards will assist private developers in rehabilitating historic buildings in downtowns and neighborhoods. Many of the buildings are vacant today and generate little economic activity. Once rehabilitated, they will drive further investment and interest in adjacent property. Developers are not issued the tax credit until project construction is complete and all program requirements are verified.

“These projects are an important investment in preserving the unique history of our communities,” said Lydia Mihalik, director of Development. “Not only do they help conserve our historic buildings, but also give them a second life and prepare our communities for the future.”

The Ohio Historic Preservation Tax Credit program is administered in partnership with the Ohio History Connection’s State Historic Preservation Office. The State Historic Preservation Office determines if a property qualifies as a historic building and that the rehabilitation plans comply with the United States Secretary of the Interior’s Standards for Rehabilitation.

Two of these properties, the Landmark Tavern in Canton and the Longfellow School in Dayton, have been featured on Preservation Ohio’s annual listing of Ohio’s Most Endangered Sites.

The Round 27 Ohio Historic Preservation Tax Credit recipients are:

Central Region

Kroger Bakery Complex (Columbus, Franklin)

Total Project Cost: $114,761,390

Total Tax Credit: $5,000,000

Address: 427-457 Cleveland Ave.

Located north of downtown Columbus, The Kroger Bakery complex encompasses two buildings: the former Kroger baker and warehouse building and the historic Ford Motor Company Assembly Plant. Bakery operations ceased in the buildings in 2019 and the site has been vacant since. Rehabilitation plans include a large residential development in the existing buildings and in newly constructed apartments on site. The historic industrial nature of the buildings will be retained while all new systems and finishes will be added.

Northeast Region

Agora Complex II (Cleveland, Cuyahoga)

Total Project Cost: $ 2,041,375

Total Tax Credit: $ 250,000

Address: 5000 Euclid Ave.

Once part of WHK Radio’s studio complex, this project will rehabilitate vacant office spaces for commercial use and 35 market rate apartments. This project is a second phase of a larger project in Cleveland’s MidTown neighborhood

Consolidated Fruit Auction Company Building (Cleveland, Cuyahoga)

Total Project Cost: $ 8,165,977

Total Tax Credit: $ 815,000

Address: 601 Stone’s Levee

Located on the Cuyahoga River across from Downtown Cleveland, this former fruit auction/warehouse building will be rehabilitated as the production facility, tasting bar, and restaurant associated with a whiskey distillery. This industrial area is largely vacant, but ripe for future redevelopment.

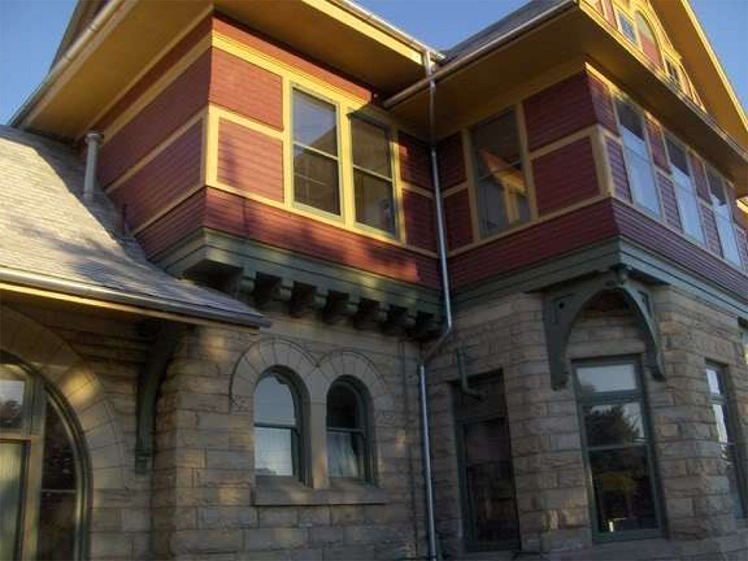

Landmark Tavern (Canton, Stark) – pictured above

Total Project Cost: $ 1,293,046

Total Tax Credit: $ 250,000

Address: 501 Tuscarawas St. E

One of the oldest buildings in Canton, the Landmark Tavern was constructed in 1818 with numerous additions in the 19th and 20th centuries. Vacant for decades, the building will be rehabilitated to again serve the public as a bar and restaurant.

McKinley Park Apartments (Canton, Stark)

Total Project Cost: $ 13,348,515

Total Tax Credit: $ 2,000,000

Address: 510 High Ave. SW

This project will rehabilitate an 11-story apartment building near downtown Canton that will again serve as affordable housing to seniors and residents with disabilities. Built in the 1960s, this building needs updated systems, elevators, and finishes as well as repair to its roof, windows, and concrete structure. Applicants are pairing historic tax credits with Low Income Housing Tax Credits.

Ohio Bell Headquarters (Cleveland, Cuyahoga)

Total Project Cost: $ 102,001,026

Total Tax Credit: $ 5,000,000

Address: 45 E. Ninth St.

Located in Cleveland’s newly designated Erieview Historic District, the former Ohio Bell Headquarters building is a large redevelopment project that will convert office space to residential and commercial space. Vacated by AT&T a couple of years ago, the building will house 368 one- and two-bedroom apartments and resident amenity spaces.

Philadelphia Rubber Works (Akron, Summit)

Total Project Cost: $ 40,291,000

Total Tax Credit: $ 4,000,000

Address: 123 West Bartges St.

This building belongs to the B.F. Goodrich Company Historic District, a grouping of eight former industrial buildings tied to Akron’s tire manufacturing history. Other buildings in the district have been, or are in the process of, being redeveloped into a variety of uses. Once complete, the building will house 97 apartments and a commercial fitness center.

Northwest Region

Overmyer Lofts (Toledo, Lucas)

Total Project Cost: $ 37,318,215

Total Tax Credit: $ 4,100,000

Address: 15 South Ontario St.

This eight-story former paper supply company and wholesale grocery building in Toledo’s warehouse district will be rehabbed as 75 market-rate apartments with commercial space on the ground floor. Vacant since 2017, the project will install all new systems as well as a new historically compatible storefront that will replace a non-original storefront that was added previously.

Security Building (Fostoria, Seneca)

Total Project Cost: $8,118,456

Total Tax Credit: $1,584,721

Address: 221 S. Main St.

Built in 1911, the Security Building in downtown Fostoria was named for its reinforced concrete “fireproof” construction method. The building served a wide variety of commercial uses over the years, once featuring skating rink, but has been vacant since its last tenant moved out in 2017. After the rehabilitation project is complete, the building will house commercial spaces on the first floor, with a mix of business suites and apartments on the upper floors.

Toledo Heritage Village II (Toledo, Lucas)

Total Project Cost: $ 4,048,000

Total Tax Credit: $ 250,000

Address: 1822 Cherry St

Located in Toledo’s Vistula Historic District, this building was once home to an ice company until it was converted to apartments in the 1980s. Currently serving as affordable housing for families and seniors, the 23-unit building will continue to serve its residents after renovation. This project includes one building but is part of a larger project with more than 30 small residential buildings in total.

Southeast Region

Quad Center, Muskingum University (New Concord, County)

Total Project Cost: $ 9,832,451

Total Tax Credit: $ 982,113

Address: 163 Stormont St.

The Quad Center, the student union at Muskingum University, will be rehabilitated to revitalize this underutilized facility and better serve the campus community. The project will add and improve ADA accessibility features and make other needed upgrades in the building. The north section will be rehabilitated for a student engagement and impact center with career counseling, job placement, video conference, and related offices while existing bookstore and dining operations will be rehabilitated for increased accessibility.

Southwest Region

20-22 Findlay Street (Cincinnati, Hamilton)

Total Project Cost: $ 1,805,482

Total Tax Credit: $ 220,000

Address: 20-22 Findlay St.

Located near Findlay Market in Over-the-Rhine, this building dates to approximately 1865 and still has its historic three-story privy, one of 10 remaining historic privies identified in the Over-the-Rhine Historic District. The building was historically mixed use with commercial and residential spaces but has been vacant for more than 10 years. After rehabilitation, the building will hold eight market-rate apartments.

1214 Race Street (Cincinnati, Hamilton)

Total Project Cost: $ 1,690,072

Total Tax Credit: $ 238,000

Address: 1214 Race St.

Built in the 1860s, this Over-the-Rhine building housed apartments until the 1980s. Most recently, it was home to a supportive housing group’s operations for 30 years but has been vacant for a few years. The rehabilitation will return it to its original residential use with seven units. The project will repair the historic storefront and retain historic interior features such as doors, trim, and mantels.

1338-1340 Main (Cincinnati, Hamilton)

Total Project Cost: $ 2,263,389

Total Tax Credit: $ 224,098

Address: 1338-1340 Main St.

This project will rehabilitate an 1850s four-story Italianate building in Over-the-Rhine for commercial and residential use. Currently vacant, it will house 11 apartments on the upper floors with office space on the ground floor. Comprehensive work to the building will include all new systems, finishes, and fixtures while preserving what historical fabric remains.

1401 Main (Cincinnati, Hamilton)

Total Project Cost: $ 2,249,680

Total Tax Credit: $ 222,741

Address: 1401 Main St.

Also known as the Adeline Building this four-story brick building was constructed around 1900 with first floor commercial spaces and 12 apartments on the upper three floors. The historic storefront will be retained as well as other interior historic trim as the building is rehabilitated to again serve its historic use.

1617-1619 Race Street (Cincinnati, Hamilton)

Total Project Cost: $ 3,328,926

Total Tax Credit: $ 250,000

Address: 1617-1619 Race St.

Located in Over-the-Rhine near Findlay Market, this project includes the rehabilitation of one historic building and new construction on an adjacent vacant lot. Once completed, the project will house 12 affordable apartments and commercial/retail spaces. The project will renew all of the building systems, roof, and windows while repairing historic features including a staircase, trim and refurbishing the historic storefront.

1931 Freeman Ave (Cincinnati, Hamilton)

Total Project Cost: $ 1,427,601

Total Tax Credit: $ 141,000

Address: 1931 Freeman Ave.

Located in Cincinnati’s Dayton Street Historic District, this 1880s building housed ground floor commercial spaces with apartments above. After more than 20 years of vacancy the building will return to its historic use. New systems will be installed, and historic cornice and storefront elements will be repaired and retained. This building is part of a larger project that includes 1935 Freeman Ave.

1935 Freeman Ave (Cincinnati, Hamilton)

Total Project Cost: $ 1,122,688

Total Tax Credit: $ 111,000

Address: 1935 Freeman Ave.

Located in Cincinnati’s Dayton Street Historic District, this 1880s building housed ground floor commercial spaces with apartments above. After more than 20 years of vacancy the building will return to its historic use. New systems will be installed, and historic cornice and storefront elements will be repaired and retained. This building is part of a larger project that includes 1931 Freeman Ave.

Barrister – 216 E. 9th St (Cincinnati, Hamilton)

Total Project Cost: $ 1,745,285

Total Tax Credit: $ 174,180

Address: 216 E 9th St

Once a large printing business, this c. 1890 building in downtown Cincinnati will be rehabilitated as affordable apartments and ground floor office space. The rehabilitation work will replace building systems and retain historic windows and other historic elements. This building will be developed in conjunction with 214 E. 9th St. as part of a larger project.

Barrister – 214 E. 9th St (Cincinnati, Hamilton)

Total Project Cost: $ 1,737,901

Total Tax Credit: $ 173,443

Address: 214 E 9th St

Built c.1885 as a shoe factory, the building had a variety of uses over the years before becoming vacant. This project includes a portion of a building in Cincinnati’s downtown that will be rehabilitated for affordable apartments on the upper floors with commercial spaces on the first floor. This building will be developed in conjunction with 216 E. 9th St. as part of a larger project.

Longfellow School (Dayton, Montgomery)

Total Project Cost: $ 30,210,000

Total Tax Credit: $ 1,841,428

Address: 245 Salem Avenue

Located in Dayton’s Grafton Hill neighborhood, the former Longfellow School was constructed beginning in the 1880s with numerous additions. Vacant since 2017, the school complex will be rehabilitated into 54 senior apartments. A new building will be constructed on an adjacent lot that will hold an additional 72 units. Performance spaces in the school will be used by a local theater group. Original features of the school will be incorporated into the residential reuse such as pressed metal ceilings, terrazzo floors, and broad hallways.

Paramount Revitalization (Cincinnati, Hamilton)

Total Project Cost: $ 23,528,904

Total Tax Credit: $ 2,000,000

Address: 2429 Gilbert Ave, 954 E. McMillan Ave, 2449 Gilbert Ave, 921 William Howard Taft Road, 2524 Gilbert Ave

The Paramount Revitalization project encompasses three historic buildings, and one new construction building in Cincinnati’s Walnut Hills neighborhood. Two of the historic buildings formerly had commercial uses while the third is a large apartment building. The new construction will be a four-story affordable apartment building on the site of a now-closed grocery store; the redevelopment is a result of extensive community collaboration. End uses identified include offices, gallery/maker space, and a restaurant.

Stearns & Foster Co. Office Building (Lockland, Hamilton)

Total Project Cost: $ 9,806,065

Total Tax Credit: $ 1,350,000

Address: 100 Williams Ave.

Located in Lockland’s new historic district, this project is one of the last remaining buildings of the large factory complex that operated there for decades. After 20 years of vacancy, the building will again serve an office use for a construction company. This district in Lockland received a Pipeline Initiative grant to be nominated to the National Register. This is Lockland’s first project to apply for historic tax credits.

Traction Building (Cincinnati, Hamilton)

Total Project Cost: $ 55,650,014

Total Tax Credit: $ 5,000,000

Address: 432 Walnut St.

Designed by architect Daniel Burnham and constructed in 1903, the Traction Building once housed the offices of the Traction Company (streetcars) as well as other office and commercial tenants in its 15 stories. The building will be rehabilitated as hotel, restaurant, and event spaces. Historic elements remain on both the exterior and interior that will be repaired and retained during rehabilitation including terra cotta details, wood trim, and windows.